DA 5226-R 1989-2024 free printable template

Show details

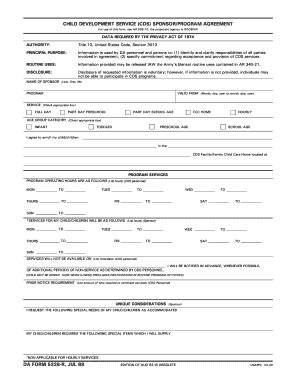

FEES WILL BE PAID IN THE FOLLOWING MANNER POLICIES CDS Personnel CHILD MEDICATION WILL BE ADMINISTERED ONLY UPON MY WRITTEN REQUEST UNDER THE FOLLOWING CDS CONDITIONS LAUNDERING CHILD S/CHILDREN S SOILED CLOTHING WILL/WILL NOT BE DONE ON A ROUTINE BASIS. I WILL PROVIDE THE FOLLOWING TO MEET CDS PROGRAM REQUIREMENTS I ACKNOWLEDGE A SHARED RESPONSIBILITY WITH CDS FOR CHILD ABUSE PREVENTION SIGNATURE OF SPONSOR DATE SIGNATURE OF CDS REPRESENTATIVE OR FCC PROVIDER REVERSE OF DA FORM 5226-R JUL...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your disclosure information form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your disclosure information form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit disclosure information online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit cds information. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

How to fill out disclosure information

How to fill out disclosure information:

01

Gather all relevant documents and information that need to be disclosed. This may include financial statements, contracts, agreements, or any other relevant documents.

02

Carefully review the disclosure form or document and understand the requirements and information that need to be provided. Make sure to follow any specific instructions or guidelines.

03

Begin filling out the disclosure information by providing accurate and up-to-date information. Ensure all required fields are completed and any relevant details are included.

04

Be transparent and thorough in disclosing any potential risks, conflicts of interest, or other important information that may impact the intended audience or recipients.

05

Double-check the completed disclosure information for any errors, omissions, or inconsistencies. Proofread the document to ensure clarity and accuracy.

06

Submit the disclosure information according to the specified method or deadline. Keep copies of the submitted document for your records.

07

Continuous monitoring and updates may be required, especially if there are changes or new developments that may impact the disclosed information.

Who needs disclosure information?

01

Individuals or entities involved in financial transactions, such as investors, shareholders, or potential business partners, may require disclosure information to make informed decisions.

02

Government regulatory agencies often require disclosure information to ensure compliance with laws and regulations and to protect the public interest.

03

Legal professionals may need disclosure information for legal proceedings, negotiations, or other legal purposes.

04

Disclosure information may also be required by lenders, creditors, or insurers to assess the financial risk associated with a particular individual or organization.

05

In some cases, individuals or organizations may proactively disclose information for ethical or transparency reasons, even if not explicitly required by any specific entity.

Video instructions and help with filling out and completing disclosure information

Instructions and Help about release information authorized

Fill da 5226 r : Try Risk Free

People Also Ask about disclosure information

What is an example of confidential information disclosure?

What is an example of a confidential information?

What is disclosure of confidential information?

What is an example of disclosure information?

What are 4 examples of confidential information?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is disclosure information?

Disclosure information refers to the details or facts that are disclosed or made known to the public or a specific group of individuals. It commonly refers to the sharing of information, often in a written form, in order to provide transparency and to fulfill legal or ethical obligations. This information can pertain to various aspects, such as financial records, legal matters, conflict of interest, personal background, risks, or any other relevant information that should be disclosed to ensure informed decision-making or to meet regulatory requirements. Disclosure information plays a vital role in maintaining trust, accountability, and good governance in various fields, including business, finance, law, and government.

Who is required to file disclosure information?

The individuals or entities required to file disclosure information vary depending on the context. Here are a few common examples:

1. Publicly traded companies: Companies listed on the stock exchange are required to file regular disclosure information with regulatory bodies, such as the Securities and Exchange Commission (SEC) in the United States.

2. Government officials: Politicians and public officials may be required to file disclosure information about their financial interests, assets, income, and potential conflicts of interest. These requirements aim to promote transparency and prevent corruption.

3. Nonprofit organizations: Nonprofits, particularly those that qualify for tax-exempt status, may need to file disclosure information with government agencies or make it available to the public. This information typically includes financial statements, executive compensation details, and information about their mission and activities.

4. Lobbyists: Lobbyists, who advocate for particular causes or interests to government officials, may be required to file disclosure information about their clients, lobbying activities, and expenses. This helps increase transparency in political influence.

It is essential to note that the specific requirements, regulations, and agencies overseeing disclosure information vary by country and jurisdiction.

How to fill out disclosure information?

To fill out disclosure information, follow these general steps:

1. Read the disclosure form:

- Understand the purpose and context of the disclosure information.

- Note any specific instructions provided on how to fill out the form.

2. Gather relevant information:

- Identify the specific details or facts that need to be disclosed. This may include personal information, financial assets, relationships, conflicts of interest, or other relevant information as requested.

3. Provide accurate information:

- Use clear and concise language to accurately and honestly disclose the required information.

- Avoid abbreviations or unclear statements that could lead to misinterpretation.

4. Organize the information:

- Fill out the disclosure form neatly and legibly.

- Ensure the information is presented in a logical and organized manner, following the provided format.

5. Double-check for completeness and correctness:

- Review the filled-in information to ensure all required fields are completed.

- Verify the accuracy of the disclosed information, including numbers, dates, and names.

6. Seek clarification if needed:

- If you're unsure about any aspect of the disclosure requirements or form, seek guidance from relevant authorities or consult legal advice.

7. Sign and date the form:

- Once you are confident in the completeness and accuracy of the information, sign and date the form as required.

- In some cases, the form may need to be witnessed or notarized.

8. Retain a copy:

- Make a copy for your personal records before submitting the disclosure form.

Remember that the specific steps and requirements for filling out disclosure information can vary depending on the purpose, context, and location. It is essential to carefully read and understand the specific instructions provided on the disclosure form prior to completing it.

What is the purpose of disclosure information?

The purpose of disclosure information is to provide transparency and ensure that relevant information about a specific subject or matter is made available to others. It is typically intended to provide detailed and accurate information that may be required by law, regulations, or established standards. Disclosure information helps individuals, organizations, or companies make informed decisions, understand potential risks, and maintain accountability and trust with others. It can include various types of information such as financial statements, legal agreements, corporate governance practices, potential conflicts of interest, environmental impacts, and other relevant data.

What is the penalty for the late filing of disclosure information?

The penalty for late filing of disclosure information can vary depending on the jurisdiction and the specific regulations in place. In many cases, the penalty may include financial fines or penalties. The exact amount of the penalty can be determined by the regulatory authority or governing body that oversees the disclosure requirements. Additionally, repeated late filing or non-compliance may result in more severe consequences such as legal action, reputational damage, or loss of certain privileges or licenses. It is recommended to consult the specific regulations in your jurisdiction or seek legal advice for accurate and up-to-date information on penalties related to late filing of disclosure information.

How can I manage my disclosure information directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your cds information and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I edit disclosure file in Chrome?

da form 5226 r fillable can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I edit release authorized on an iOS device?

Create, edit, and share authorized individual form from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

Fill out your disclosure information online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Disclosure File is not the form you're looking for?Search for another form here.

Keywords relevant to form 5226

Related to disclosure release information

If you believe that this page should be taken down, please follow our DMCA take down process

here

.